POSTED : June 2, 2022

BY : Patrick Smith

For the first time in nearly a century, we are witnessing an acceleration of major innovations within the automotive industry. The adoption of battery electric vehicles (BEVs) and hybrid models keeps increasing, with sales of both nearly doubling from 308,000 in 2020 to 608,000 in 2021. Beyond the new demand for “green” vehicles, there are other innovations in the automotive space. Connected, autonomous, and drive-by-wire software technologies are fundamentally changing the driving experience. Vehicle service will be less frequent, more over-the-air, and increasingly separated from sales showrooms. And with the coming age of the metaverse and 5G technology, the ownership experience will continue to evolve significantly.

In our view, acceptance of these changes will follow the innovation adoption curve that we’ve seen time and again. The adoption curve includes early adopters of new technology, those resistant to change (the laggards), and everyone in between, who have varying attitudes toward adoption.

Over the next five to ten years, areas of key resistance to the BEV revolution will diminish as the infrastructure matures and charging becomes as easy and convenient as gas fueling is currently. It seems that every week, another charging station startup receives millions in funding, with a multimillion-dollar valuation. Charging stations will continue to proliferate, and they’ll be just as plentiful as gas stations within a few years. With these changes unfolding in the automotive industry, dealers will need to meet customers’ expectations not only for advanced technology in vehicles, but also for an easy, frictionless, and mostly digital automotive buying experience.

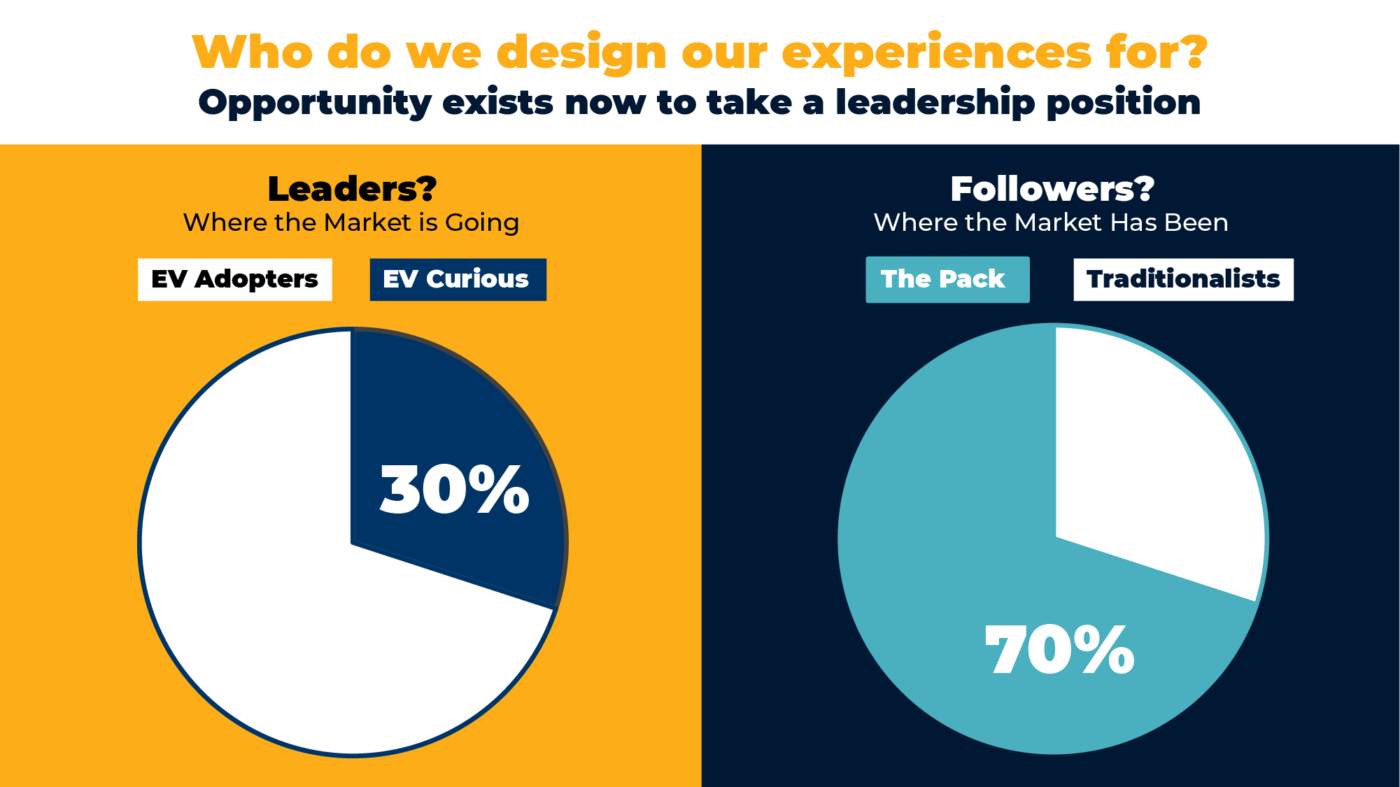

As a result of these innovations, about 30% of market share and billions of dollars in new revenue streams are up for grabs by 2030. This begs the question: who are you designing your experiences for—the early adopters or the laggards?

Below, we highlight the research we conducted with over 1,000 in-market automotive buyers to understand what they expect and how they are a driving force behind the coming changes.

Just because you’re a winner today doesn’t mean you’re going to stay a winner if you don’t make the right investments in your automotive buyer experience. To better understand automotive buyer mindsets, attitudes, and expectations regarding innovation, we conducted market research using our Voice of the Customer experts. Here are some takeaways:

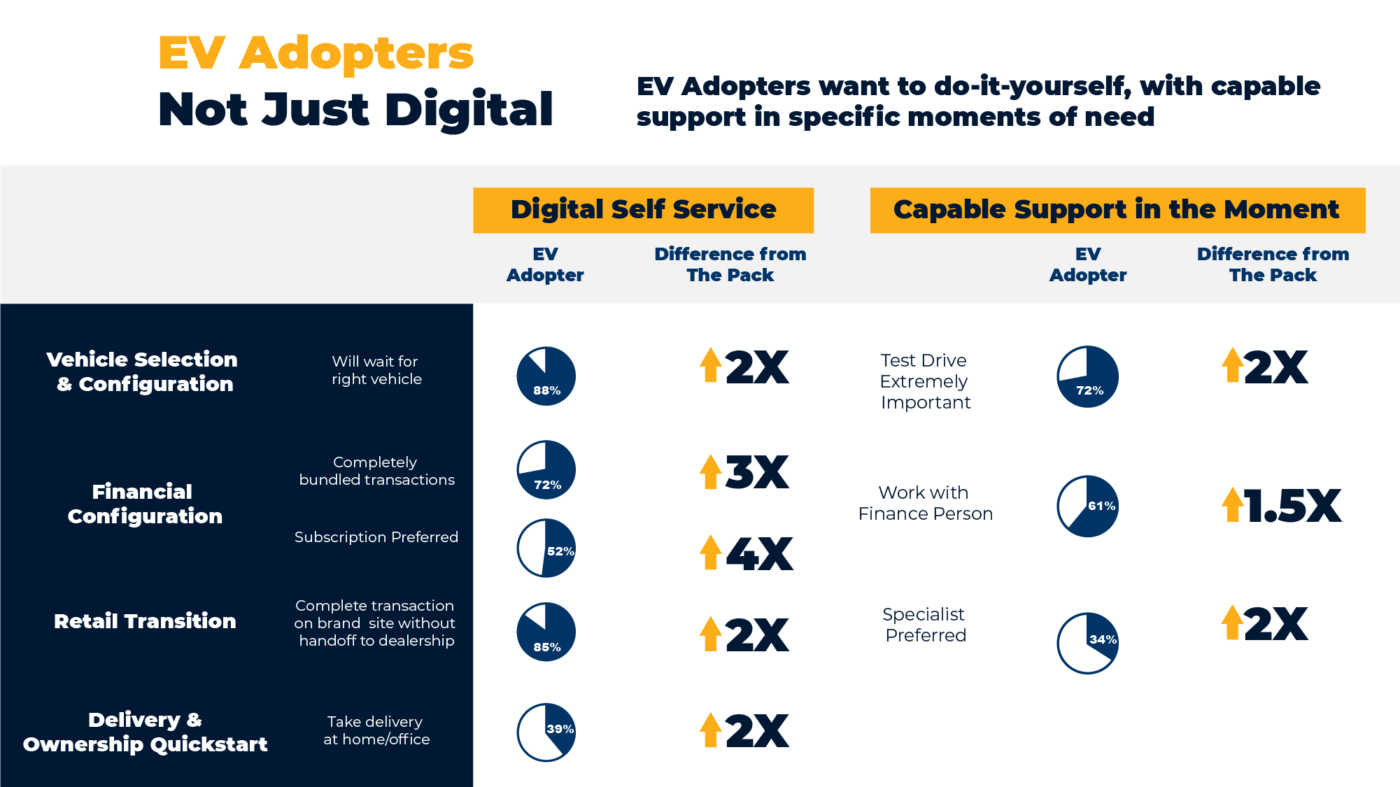

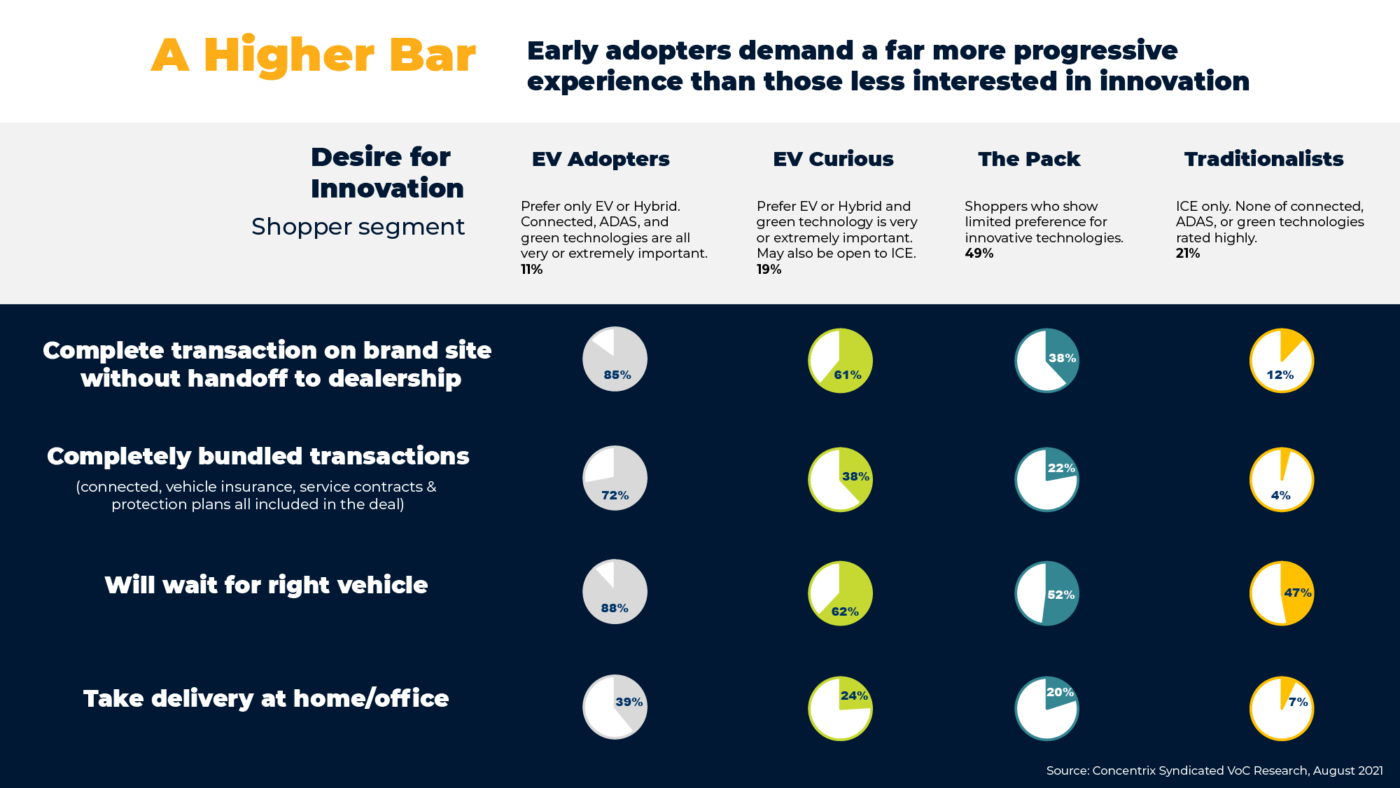

Innovation Adopters comprised 11% of respondents we researched. They preferred only BEV or hybrid models, and reported that connected, ADAS, and green technologies are all very or extremely important to them. Here are some other findings about Innovation Adopters:

In addition, when considering which type of car to purchase, the Innovation Adopters lean towards luxury brands.

The Innovation Curious, at 19% of people surveyed, would prefer an BEV or hybrid model car, but are also open to internal combustion engines. They responded that green technology is very or extremely important to them. Compared with Innovation Adopters, only 61% want to complete their transaction on the brand’s website, 38% want a completely bundled transaction, 62% will wait for the right vehicle, and 39% will take a delivery at their home or office.

The largest cohort, the Pack, contains 49% of respondents. These shoppers show limited preference for innovative technologies, with only 38% favoring a transaction on the brand’s website, 22% wanting completely bundled transactions, and 20% willing to take their delivery at their home or office. Slightly more than half (52%) are willing to wait for the right vehicle.

The last group, the Traditionalists, prefer to stick with their tried-and-true internal combustion engines, because they simply don’t want to change. One reason they don’t seek change is due to their worries about range, cost, and model availability for electric vehicles. As for other innovative experiences, only 12% would prefer to complete their transaction on the brand website, 4% want bundled transactions, and 7% would take their delivery at their home or office. Slightly less than half, however, are willing to wait for the right vehicle, at 47%.

It’s simple: to provide an experience that meets automotive buyer expectations, you need to create experiences for the Innovation Adopters—both online and offline. In doing so, you will also address many of the remaining customers’ needs. In an upcoming post, we’ll outline how you can inject innovation into your buying experience.

Learn more about what sets our CX expertise apart.

Senior Director, Product Strategy and Marketing