POSTED : October 3, 2016

BY : Clay Walton-House

Categories: Loyalty & Connected Membership,Strategy & Design

The science and art of measuring marketing effectiveness, especially when it comes to tracking customer lifetime value, has been an evolving organizational discipline within enterprise businesses for a number of years. New technologies and ways customers interact with brands have meant new data sets, new challenges with integration, and—most importantly—new opportunity for greater insight into your customers and their needs, preferences, and behaviors.

This series of Featured Columnist articles focuses on the topic of “Integrated Loyalty,” which is simply summarized as taking a holistic approach to developing customer relationships, using all organizational levers, not just traditional loyalty marketing tactics. With regards to measurement in particular, this concept implies that measurement of success should also be holistic, tracking performance against growing real customer relationships and, ultimately, extracting business value from those relationships.

In the world of loyalty marketing, however, many companies still find themselves executing on measurement plans within their organizational silo. Loyalty marketing teams tend to have no problem measuring the foundational elements of success related to their tactics—loyalty program penetration rates, engagement/activity rates, and even incremental retention driven by a loyalty program. These operational metrics are often augmented by some form of attitudinal indicator of success, whether it be Net Promoter Score, Customer Satisfaction, or another attitudinal measure. These metrics are important, and yet leave gaping holes in a holistic view of the overarching health of a customer base.

So what does it look like to measure customer lifetime value holistically, in an integrated fashion?

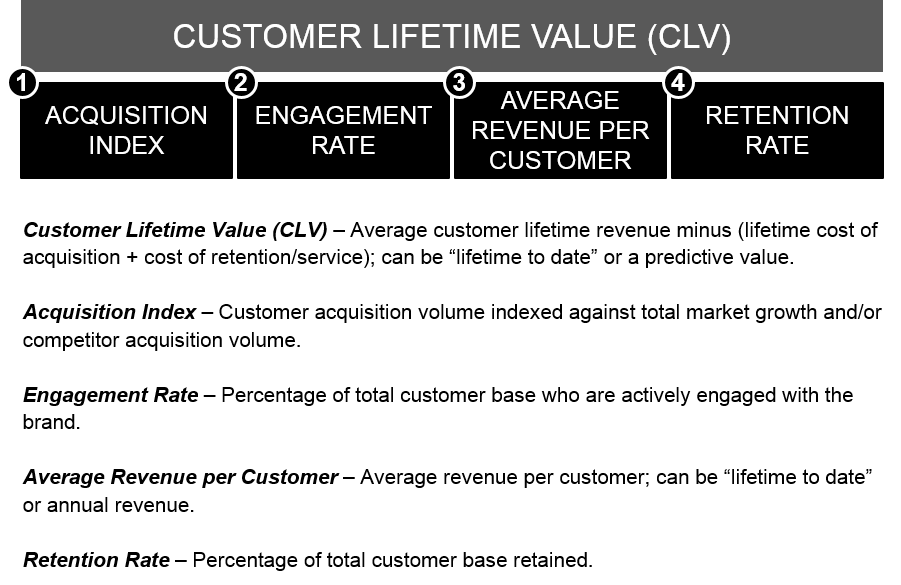

Here is a simple framework to serve as a starter:

Though loyalty marketers are rightly focused deeply on retention and loyalty to the brand, there is more required to really understand how customers are interacting across their journey. Boiling down the business into four primary “customer motions”—Acquire, Engage, Grow, and Retain—provides a simple tool for distilling the performance of the business in developing customer relationships end-to-end. Add an overarching “composite” indicator of customer health to serve as a “North Star” (Customer Lifetime Value would be the best-practice), and a robust, yet elegant measurement model emerges.

Brands should take the time to establish their unique set of metrics for each motion, being careful to keep things simple by selecting one overarching indicator of health for each. This is important in order to create a simple, consumable framework of five customer health metrics that stakeholders can view across the organization to understand performance through a customer-centric lens.

Here is an example customer lifetime value framework highlighting five potential metrics brands may use, along with high-level definitions. Note that this should vary significantly by industry. This example would apply to Telecom and other similar business models:

In addition to defining the metrics to create an overarching, holistic view of customer health, there is also the detail of the measurement methodology itself—namely, how the customer base is defined, what time-based lens is applied to the data, etc.

Here are three fundamentals that ensure a customer-centric, holistic view is achieved:

This is nuanced, and may sound simple, but in fact it’s very difficult for many large enterprises due to the size of the data being processed. The nuance lies in the detail: Measuring at the customer level means being able to track “movement” of individual customers over time—and for some very important KPIs related to retention, save, and win-back in particular, it’s imperative a holistic view of customer lifetime value includes the ability to see how unique customers are “moving” from one state of relationship with the brand to another. This allows the organization to observe trends in who these customers are month over month, year over year, etc. Measuring at an aggregate level will show you population sizes and averages for customers in various stages of relationship, but will lack the deeper insights into the specifics of what those populations look like.

Your customer is your customer, regardless of how much you know about them or how engaged they may be. To size the total business opportunity, and measure customer health holistically, brands must measure performance against building relationships with the total customer base. Sounds simple, yet two tactical elements often prevent this from happening: First, brands can’t identify and track unique customers without a unique identifier—often email, phone number, etc., before assigning a customer ID. Yet there are ways around this challenge using payment methods as identifiers, and deploying de-duplication methodologies to improve accuracy as much as possible. Though imperfect, for many brands who only capture contact info for a minority of their customer base, this method is vastly preferable to not having insight into the total base at all. The second element often preventing brands from measuring performance against their total customer base is an inherent bias toward those customers who are “active.” It’s easier to measure only those customers who have recently transacted, and yet depending on the business model, doing this can obscure where the greatest opportunity often lies for brands. Many companies have a “long tail” of low-value customers who make up a vast majority of the base, and relatively small incremental growth of the long tail can often be the greatest opportunity to increase gross revenue.

Businesses have a tendency to muddy the measurement waters by putting a business-centric view on data. Calendar or fiscal years are the most common time ranges applied to the data for defining success—how many customers transacted this year? How many did we “retain” because they transacted two calendar years in a row? These are not customer-centric measures, but business-centric. Real people aren’t defined by calendar years, but by their human lifetime. Brands can and should track their trending performance in alignment with their business rhythm, whether it be monthly, quarterly, or annually—yet the key is to not define the metrics themselves based on the same rhythm.

Applying these three fundamentals to how customer health is measured can immediately improve the level of insight into true customer behaviors and areas of weakness within the business, and should be part of any brand’s effort to mobilize a more integrated approach to customer loyalty.

Learn how to measure a loyalty program’s value by downloading our report A new methodology for predicting the ROI of a loyalty program.

Tags: Customer Analytics and Insights, Customer Lifecycle, Customer Lifetime Value, Customer Measurement